(AGENPARL) - Roma, 26 Marzo 2021

(AGENPARL) - Roma, 26 Marzo 2021Content

This is the concept that a business should report the results of its operations over a standard period of time. This may qualify as the most glaringly obvious of all accounting principles, but is intended to create a standard set of comparable periods, which is useful for trend analysis.

- Certain countries adhere to particular standards, but some of these laws are more universally understood globally.

- This is the concept that a business should report the results of its operations over a standard period of time.

- Now, as the market changes, the selling value of this machinery comes down to $50,000.

- There are 10 Generally Accepted Accounting Principles as set by the Financial Accounting Standards Board.

- These includes the principles of regularity, consistency, sincerity, permanence of methods, non-compensation, prudence, continuity, periodicity, materiality, and utmost good faith.

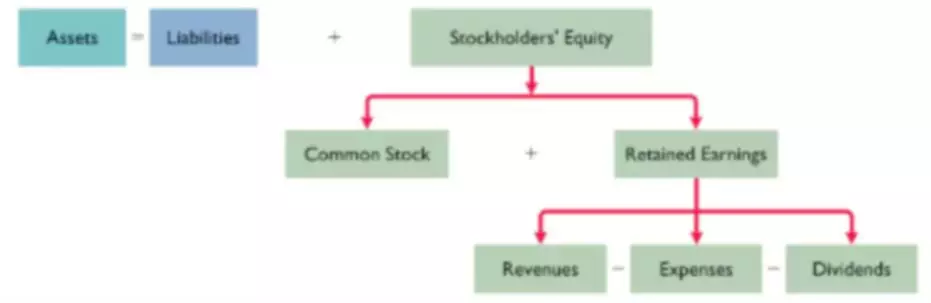

The total income of an entity minus total expenses gives us the “Net Profit” or “Net Loss” of the business entity. At Fundamentals of Accounting, our objective is to present complex accounting concepts in an easy and understandable fundamental accounting manner. Under the going concern assumption, a common time frame might be twelve months. However, one should presume the business is doing well enough to continue operations unless there is evidence to the contrary.

Statement of Cash Flows

“Competent professional service” means using the education provided by both school and the work field to provide a service that provides value to you. To be able to provide you with competent service, we need to continue our education throughout the years and stay up-to-date with all accounting principles and standards. We’ll notify you of any limitations in our capabilities regarding any task that you’d inquire from us and whether we can do it with professionalism and diligence.

What are the 6 golden rules of accounting?

- Debit what comes in, Credit what goes out.

- Debit the receiver, Credit the giver.

- Debit all expenses Credit all income.

Assets acquired for long-term use should be reported at their historical cost, regardless of whether the current market value exceeds or falls below the original cost. This is the concept that only those transactions that can be proven should be recorded. For example, a supplier invoice is solid evidence that an expense has been recorded. This concept is of prime interest to auditors, who are constantly in search of the evidence supporting transactions. This is the concept that a business will remain in operation for the foreseeable future.

Unlock Your Education

This is the concept that you should record a transaction in the accounting records if not doing so might have altered the decision making process of someone reading the company’s financial statements. This is quite a vague concept that is difficult to quantify, which has led some of the more picayune controllers to record even the smallest transactions. This is the concept that a business should only record its assets, liabilities, and equity investments at their original purchase costs. This principle is becoming less valid, as a host of accounting standards are heading in the direction of adjusting assets and liabilities to their fair values. Since accounting principles differ around the world, investors should take caution when comparing the financial statements of companies from different countries. The issue of differing accounting principles is less of a concern in more mature markets.

This ensures that financial statements are comparable between periods and throughout the company’s history. Generally accepted accounting principles and International Financial Reporting Standards are actually based on the fundamental accounting principles and concepts discussed in this chapter. It’s essential https://www.bookstime.com/ for any business to have basic accounting principles in mind to ensure the most accurate financial position. Your clients and stakeholders maintain trust within your company, so recording reliable and certified information is key. To better understand the principles, let’s take a look at what they are.