(AGENPARL) - Roma, 15 Marzo 2023

(AGENPARL) - Roma, 15 Marzo 2023(AGENPARL) – WASHINGTON mer 15 marzo 2023

?

U.S. crude oil exports increased to a new record of 3.6 million barrels per day in 2022

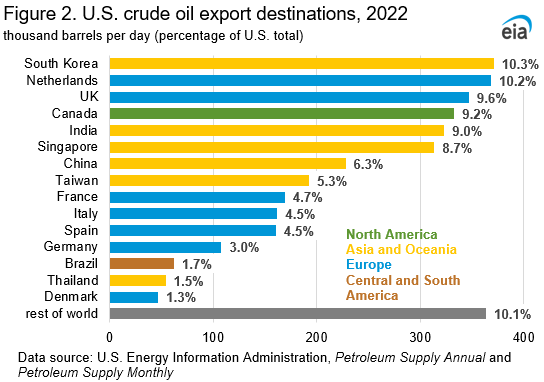

U.S. crude oil exports averaged a record 3.6 million barrels per day (b/d) in 2022, a 22% increase (640,000 b/d) from 2021 (Figure 1). The number of destinations for U.S. crude oil exports in 2022 decreased from 39 to 38. South Korea received the largest share (10.3%, or 371,000 b/d) for the first time, followed by the Netherlands (10.2%, or 368,000 b/d) and the UK (9.6%, or 347,000 b/d). U.S. exports to India (the top export destination in 2021) and China (the top export destination in 2020) declined the most, as Western sanctions on Russia’s crude oil exports shifted trade patterns. These decreases were more than offset by increases to other destinations, particularly in Europe. The growth in U.S. crude oil exports was driven by increased U.S. crude oil production, releases from the U.S. Strategic Petroleum Reserve, and increased global demand for alternatives to Russia’s crude oil.

Asia and Oceania was the top regional destination for U.S. crude oil exports in 2022, representing 43% (1.55 million b/d) (Figure 2). Asia and Oceania has been the largest destination by volume for U.S. crude oil since 2017. Europe ranked second as a regional destination for U.S. crude oil exports, representing 42% (1.51 million b/d) in 2022. Europe has been the second-largest destination by volume for U.S. crude oil since 2018. Of the 15 top destinations for U.S. crude oil exports, 6 were in Asia and 7 were in Europe. Canada dropped to the fourth-largest destination for U.S. crude oil exports for the first time since the end of the U.S. crude oil export ban in 2015. Prior to 2020, Canada had been the single largest destination for U.S. crude oil exports for over 20 years, reflecting large crude oil and petroleum product trade flows between the two countries. In recent years, new U.S. crude oil production has mostly been light, low-sulfur crude oils that U.S. Gulf Coast refineries are not optimized to process. With increasing global demand for light, low-sulfur crude oils, these new barrels have increased U.S. crude oil exports to Asia and Europe.

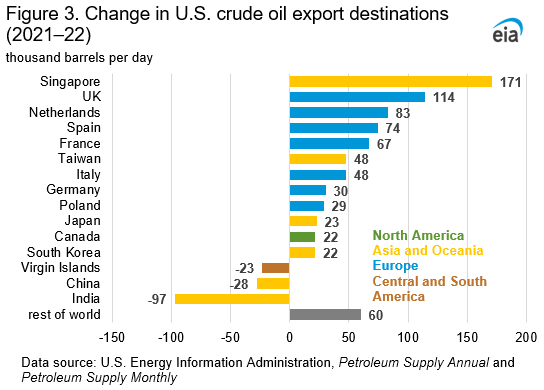

Western sanctions on Russia’s exports increased U.S. crude oil exports to Europe and decreased U.S. crude oil exports to countries that elected to purchase more of Russia’s crude oil at a discount. U.S. exports to Europe increased 41% (437,000 b/d) compared with 2021 (Figure 3). Seven of the top ten export destinations that increased purchases of U.S. crude oil were in Europe, and many of these European destinations saw a noticeable uptick after Russia’s full-scale invasion of Ukraine began in February 2022. Prior to 2022, OECD Europe had been the top regional importer of Russia’s crude oil, receiving 2.3 million b/d from Russia in 2021. EU sanctions implemented in December 2022 that prohibit all seaborne imports of Russia’s oil to Europe make it likely that demand for U.S. crude oil will continue in 2023. Exports to Asia and Oceania increased by 13% (178,000 b/d) in 2022. China and India collectively reduced their purchases of U.S. crude oil by 19% (125,000 b/d) in favor of cheaper oil from Russia. In addition, China recorded less crude oil imports overall due to reduced domestic demand for petroleum products and lower export quotas for petroleum products that reduced demand for crude oil processing. An increase of 120% (171,000 b/d) in U.S. exports to Singapore, from 143,000 b/d in 2021 to 314,000 b/d in 2022, as well as increases to Taiwan, Japan, and South Korea, more than offset that decline.

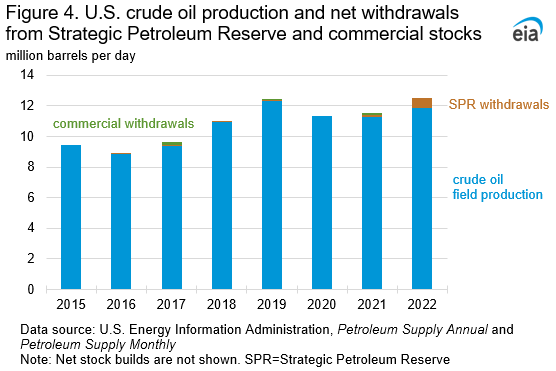

Increased U.S. crude oil production supplemented by a large withdrawal from the Strategic Petroleum Reserve (SPR) allowed for greater volumes of U.S. crude oil exports. U.S. crude oil production increased 5.6% (629,000 b/d) to 11.9 million b/d in 2022 (Figure 4). Production was 3.5% (432,000 b/d) less than the record high of 12.3 million b/d recorded in 2019. When including net stock withdrawals, however, U.S. crude oil supplied to the market surpassed 2019. U.S. crude oil production, combined with the SPR withdrawal and U.S. commercial inventory changes, reached 12.5 million b/d in 2022, 0.7% (87,000 b/d) more than the 12.4 million b/d supplied in 2019. Considering U.S. commercial crude oil inventories recorded a build of 23,000 b/d in 2022 (about 4% of the total SPR withdrawal), the SPR was a significant source of crude oil for domestic refining as well as U.S. crude oil exports. Several emergency releases from the SPR, made to temper rapidly rising crude oil prices, resulted in 222 million barrels or 607,000 b/d of additional crude oil available in the market in 2022 (nearly equal to the growth in U.S. crude oil production that year).

For questions about This Week in Petroleum, contact the Petroleum and Liquid Fuels Markets Team at 202-586-5840.

Fonte/Source: https://www.eia.gov/petroleum/weekly/archive/2023/230315/includes/analysis_print.php