(AGENPARL) - Roma, 23 Giugno 2022

(AGENPARL) - Roma, 23 Giugno 2022(AGENPARL) – WASHINGTON gio 23 giugno 2022

?

Notice: Systems issues have delayed several of EIA products scheduled for release this week that are used to populate the graphs and data tables published in This Week in Petroleum. Our experts are working on a solution to restore the affected systems.

U.S. refinery capacity decreased for second consecutive year

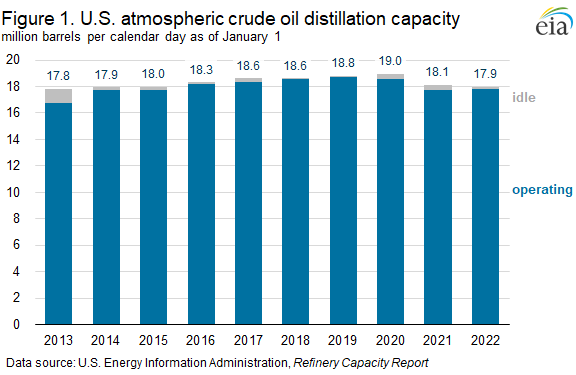

Operable atmospheric crude oil distillation capacity, the primary measure of refinery capacity, totaled 17.9 million barrels per calendar day (b/cd) in the United States at the start of 2022, down 184,000 b/cd (1.0%) from 18.1 million b/cd at the start of 2021. According to our annual <a href="https://www.eia.gov/petroleum/refinerycapacity/" text="Refinery Capacity Report“>Refinery Capacity Report, 2021 marks the second consecutive year of decreasing refinery capacity after a 0.8 million b/cd decline in 2020 (Figure 1).

We produce two measures of refinery capacity: barrels per calendar day (b/cd) and barrels per stream day (b/sd). Calendar-day capacity represents the operator’s estimate of the input that a distillation unit can process in a 24-hour period under usual operating conditions, taking into account the effects of both planned and unplanned maintenance. Stream-day capacity reflects the maximum input that a distillation facility can process within a 24-hour period when running at full capacity with an optimal crude oil and product slate and with no allowance for downtime. Stream-day capacity is typically about 6% higher than calendar-day capacity.

Although total U.S. refining capacity decreased in 2021, the number of operable refineries in the United States (excluding U.S. territories)—which includes both idle and operating refineries—increased to 130 refineries at the beginning of 2022, up from 129 refineries at the beginning of 2021. The increased total number of refineries in the report includes the addition of two new facilities and the closure of a third. The new facilities are the Texas International Terminals facility in Galveston, Texas, where a 45,000-b/cd atmospheric distillation unit was built at a refined products terminal, and the Talley Asphalt Products facility in Kern, California, where a 1,700-b/cd distillation unit was reported as part of an asphalt plant. The only facility that was closed and removed in the 2022 Refinery Capacity Report was the 255,600-b/cd Phillips 66 refinery in Belle Chasse, Louisiana (also called the Alliance refinery) which stopped refining operations following substantial flooding related to Hurricane Ida. We also noted capacity changes at other existing facilities between 2021 and 2022.

Several refineries closed during 2020, largely as a result of the pandemic’s impact on the U.S. refining sector. The 2021 Refinery Capacity Report reflected most of these refinery closures, which were addressed in a previous This Week in Petroleum that accompanied the report’s release. According to the 2021 and 2022 editions of the Refinery Capacity Report, just over 1.0 million b/cd of refinery capacity has closed since January 2020. Several factors contributed to the refinery closures in 2020 and 2021, including site-specific incidents and transitions to renewable diesel production.

The 2022 Refinery Capacity Report does not reflect a handful of impending constraints on U.S. refining capacity because the closures were not in effect as of January 2022. Phillips 66 has announced plans to stop refining petroleum at its 120,200-b/cd Rodeo refinery in California while the facility transitions to refining biofuels, but it had still not terminated its refining operations as of January 1, 2022. Similarly, LyondellBasell announced that its 263,776-b/cd refinery in Houston will close by the end of 2023, but the refinery has not yet stopped operations. The Refinery Capacity Report includes the capacity of both facilities. We have transitioned to idle the 176,400-b/cd Limetree Bay refinery in the U.S. Virgin Islands, which was briefly operational in 2021 before stopping production; however, the 2022 Refinery Capacity Report includes this refinery because it was not decommissioned as of January 1, 2022.

Three refinery sales took place in 2021. Cenovus Energy purchased the 179,000-b/cd Lima refinery in Ohio and the 38,000-b/cd Superior refinery in Wisconsin from Husky in February 2021. HollyFrontier purchased the 145,000-b/cd Anacortes refinery (also called the Puget Sound refinery) in Washington State from Royal Dutch Shell. We did not include sales of refineries that were announced but were not finalized as of January 2022.

As refinery inputs increased and refinery capacity decreased in 2021, annual refinery utilization increased to 87%, compared with 79% in 2020. Despite this increase, 2021 refinery inputs remained below pre-pandemic annual average input levels (Figure 2). Because we calculate refinery utilization by dividing total gross refinery inputs by total crude oil distillation capacity, decreases in capacity can contribute to increased refinery utilization given nearly equal refinery input volume.

The U.S. refining fleet can only maintain a certain level of utilization in order to account for necessary maintenance, unforeseen disruptions, and general safety, which makes running at 100% utilization of capacity for a sustained period of time extremely difficult. The average annual refinery utilization over the last 10 years (2012–2021) was about 89%, and the maximum for any individual year during that time period was 93% in 2018. As a result of continued reductions in U.S. refinery capacity, utilization would need to increase to produce equivalent volumes of petroleum products?such as motor gasoline or diesel?compared with historical production levels.

Constraints on refinery capacity are contributing to current high prices for motor gasoline and diesel this summer and the widening price differentials between the U.S. East Coast and U.S. Gulf Coast.

Net inputs of crude oil to U.S. refineries averaged 15.1 million barrels per day (b/d) in 2021, an increase of 0.9 million b/d from 2020, which had the lowest annual refinery runs in more than a decade (Figure 3). Crude oil runs in 2021 remained below 2019 levels by 1.4 million b/d. The increase in crude oil runs in 2021 was primarily met by more net imports of crude oil (because of both increasing imports and decreasing exports), as domestic production of crude oil decreased by less than 0.1 million b/d, year-over-year. U.S. refinery inputs in 2021 also resulted in substantial stock withdrawals to meet demand for crude oil, and inventories decreased by 108 million barrels over the course of the year.

As the United States has increased domestic crude oil production over the past decade, the average density of U.S. crude oil, measured in API gravity, has become lighter. Refineries in the United States with substantial secondary conversion capacity, particularly those along the U.S. Gulf Coast (PADD 3), can process denser crude oil grades, which have a low API gravity and high sulfur content. However, many U.S. refineries (particularly those in the Gulf Coast) are also geographically well positioned to take advantage of increasing domestic crude oil production. This trend has contributed to the average weighted API of U.S. crude oil inputs increasing to 33.2 in 2021 compared with 33.0 in 2020, 32.9 in 2019, and 30.4 in 2011.

When refined, lighter crude oil grades (with higher API gravity) produce larger yields of more valuable petroleum products such as gasoline, naphtha, distillates, and jet fuel. As a result, lighter crude oil grades often benefit from a price premium compared with heavier grades (lower API gravity), which produce more asphalt and residual fuel oil and tend to sell at a discount. Secondary conversion units, such as catalytic cracking, catalytic hydrocracking, and thermal cracking (or coking) units, enable refiners to transform low value residuals from heavier crude oil grades into more high-value products. West Texas Intermediate (WTI), the U.S. benchmark crude oil grade, has an API gravity of about 40, but many U.S. refiners still import discounted heavier crude oils in order to use secondary conversion units (Figure 4). As an alternative to processing heavier crude oil grades, some refiners also import heavier, unfinished residual fuel oils and blend them with lighter crude oils or feed them directly into conversion units. Historically, a small number of U.S. refineries have imported most unfinished fuel oil imports from Russia, although this trend is likely to change after the United States banned imports of Russia’s energy products beginning in March 2022.

In 2021, catalytic cracking decreased by 1.9% in the United States, and coking capacity decreased by 1.1%; however, catalytic hydrocracking capacity increased by 0.4%. Desulfurization capacity, which is used to bring gasoline and diesel fuel into compliance with on-road emissions standards, also decreased by 1.1%.

<!–

Notice: On-Highway Diesel Fuel Price Survey Methodology Change

EIA now provides weekly estimates of U.S. distillate fuel oil stocks, 15 parts per million (ppm) sulfur and under, by type of storage facility (bulk terminals, pipelines, and refineries). This information is a temporary addition to the Weekly Petroleum Status Report (WPSR) in order to help stakeholders assess distillate fuel oil market conditions.

–>

For questions about This Week in Petroleum, contact the Petroleum and Liquid Fuels Markets Team at 202-586-5840.

Fonte/Source: https://www.eia.gov/petroleum/weekly/archive/2022/220623/includes/analysis_print.php